| |

REAL ESTATE MARKET SNAPSHOT |

|

|

Our market here on Vancouver Island continues to remain active & balanced. "The Island continues to buck the trend of declining home sales currently experienced on the mainland,” says Jason Yochim, the Vancouver Island Real Estate Board's CEO. He also reported inventory above the 10 year average across the VIREB market area. Here in the Cowichan Valley, the number of new listings dropped for most types of Real Estate and many buyers are reporting they have been looking but are not always finding what they need. |

|

|

Our local Market conditions for May 2025 over May 2024 appear to show we are somewhat on par with the mainland. Sales dropped across the board for all types of Real Estate (however sales were up 6.60% for Single Family Homes over the last 12 months to date). The Benchmark price for a Single Family Home in the Cowichan Valley thru May 2025 was $806,800, up four per cent over May 2024.

SINGLE FAMILY Sales -13.25%, Average Sale Price +6.11% & New Listings +0.68%

CONDOS

Sales -33.33%, Average Sale Price -8.77% & New Listings +64.71%

TOWNHOMES Sales -45.00%, Average Sale Price -5.19 & New Listings -8.57%

LAND Sales -66.67%, Average Sale Price -15.19% & New Listings -24.00%

Learn more about market conditions on Vancouver Island & across BC here: 👉https://vireb.com/market-report and watch BCREA's May Update👇 |  |

|

|

|

SHOULD YOU WAIT FOR RATES TO DROP?

Here's Why it's Worth a Call to Your Local, Cowichan Valley Mortgage Broker: | With the right financing strategy in place, Janette Roch and her "RochStar" Mortgage Team can help you make confident moves, whether you're entering the market, planning your next purchase, or looking to optimize your current mortgage. | One of the biggest questions people are asking right now is: “Should I wait for interest rates to drop before buying?” 🤔

It’s a fair question, but waiting doesn’t always lead to a better deal. With the recent update from the Bank of Canada and where fixed mortgage rates currently sit, here’s what you should know:

On June 4th, there were no changes to the Prime Lending rate as the Bank of Canada took a cautious approach due to mixed economic signals. The key drivers behind the decision being: - Economic Growth Slowing: After a 2.2% GDP increase in Q1, the economy is showing signs of softening, prompting the Bank to wait and watch.

- Inflation Still a Concern: Core inflation hit 3.15% in April, its fastest pace in nearly a year.

- Trade Risks Remain: Uncertainty around U.S. tariffs and trade policies continues to cloud Canada’s economic outlook.

| The current environment has kept fixed mortgage rates in the mid to low 4% range which is historically stable, and far below the highs of 2022–23. With both the fixed and variable rates staying relatively stable, consider the following instead of relying solely on the hope of future rate decreases:

- Rates are already competitive: While not at pandemic-era lows, today’s rates are very favorable over the long term.

- Waiting might not equal savings: A 0.25% rate drop on a $600,000 mortgage saves about $80/month—but that can easily be offset by a $20,000 price increase as more buyers enter the market.

- More buying power now: With many would-be buyers waiting, there’s less competition, more inventory, and stronger negotiating power for those who act now.

- You can always refinance: Securing a mortgage today doesn’t mean you're stuck. If rates fall, you may have the option to refinance. Clients with debt or higher mortgage rates can benefit today with a mortgage check in.

- Peace of mind over perfect timing: The perfect window is hard to spot in real time. Acting during a stable stretch like this offers clarity, control, and long-term benefits.

| Timing the market is always tricky, but with solid rates, reduced competition, and the flexibility to refinance, now could be the right time to make a move. Whether you're buying, refinancing, or just exploring your options, We are here to guide you. Let’s create a plan that aligns with your goals and provides confidence in today’s market. Reach out by phone or email for a personalized mortgage review or pre-approval. No pressure, just clear advice.

|

|

|

Next Bank of Canada Decision: July 30, 2025 | Rates & Info Courtesy of Janette Roch at Dominion Lending Get in touch with her today to explore your mortgage options! |  |

|

|

|

|

UPCOMING EVENTSMark your calendars!

| 🎣FATHER'S DAY - SUN, JUNE 15

|

|

|

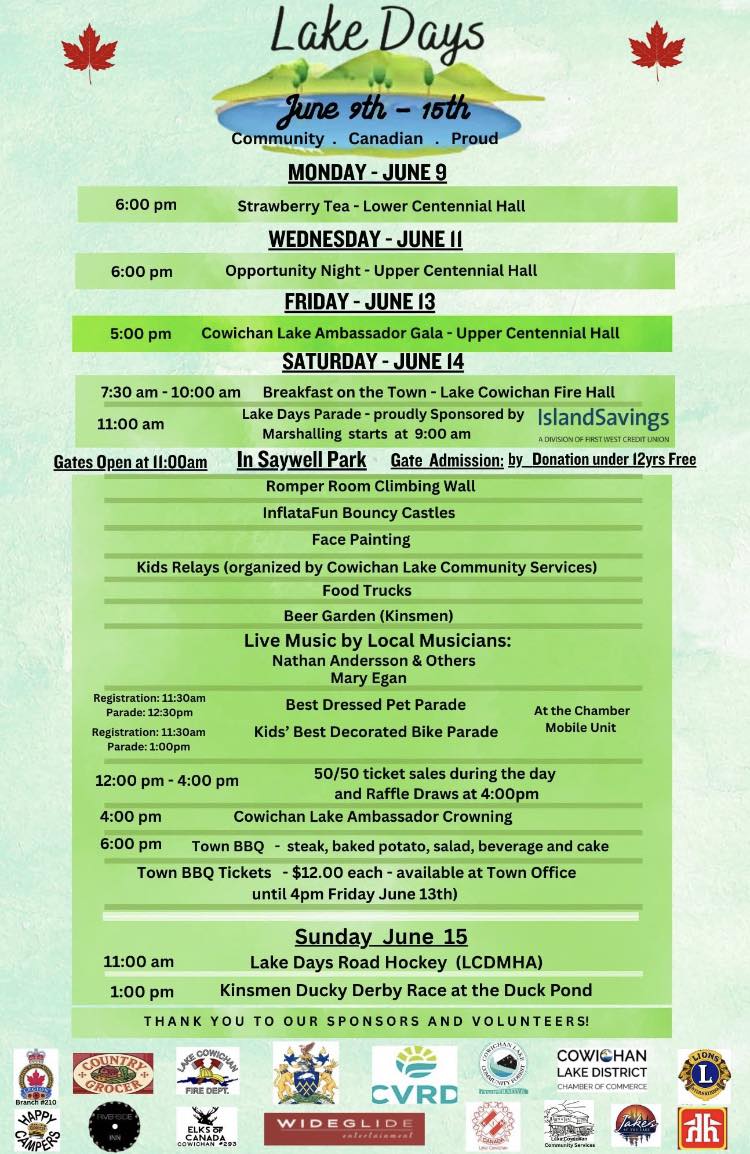

| June 9th-15th | Check out Lake Days in Lake Cowichan! This annual event is fun for the whole family and is proudly sponsored by a host of local businesses! Don't miss it!

Saywell Park South Shore Road Lake Cowichan |

| |

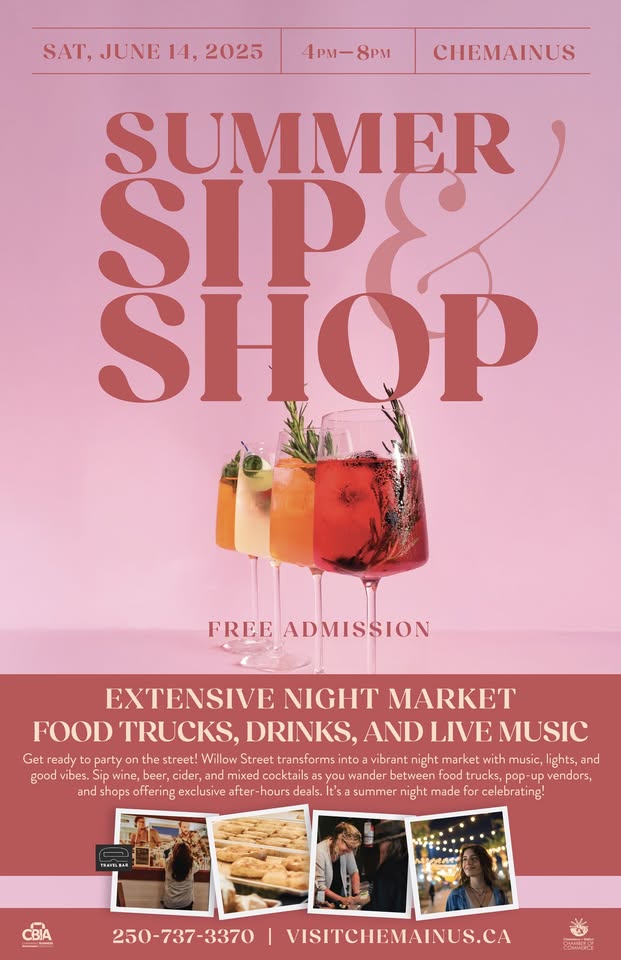

| June 14th

4:00-8:00PM | Downtown Chemainus Summer Sip & Shop! Gather your friends, bring your shopping bags, and come experience downtown Chemainus like never before — vibrant, festive, and full of summer energy!

Willows Street/ Waterwheel park

Chemainus |

|

| June 13 6:30-8:30PM | Kick off Summer Pool Party!

Dive into Summer at the Frank Jameson Community Centre Pool. Swimming, games, fun activities and an epic water fight!

810 6th Ave Ladysmith |

|

|

|

|

Team Building Paint Night! | The team takes a break from putting up signs and tries their hand at painting some. Big Thank You to Melissa & Kerri at Pemberton Holmes Duncan for organizing this super fun team building event. 💖🙏 And, thank you to Caleigh for standing in for Jenney. It was so nice getting to know you 🥰 |

|

|

|

Mini Coop Gets a Makeover! | And we're just so excited! Watch for Ally out & about, cruising with the top down this month for your chance to Win! 😎🌞 Big shout out to Ty at Island Auto Wrap for the fabulous make over!

Click HERE for more contest details! |

|

|

The Team Collaborates to bring Stanley Creek to Market | The Team, in partnership with Jada Forrest & Adam Sandhu from our Lake Cowichan Pemberton Holmes Office, collaborate with Plante Construction and Development to bring these affordable new homes with suites on the market! Perfect for new buyers looking for a mortgage helper or families looking to purchase jointly. Brand new and priced to qualify for GST & Transfer Tax rebates! |

|

|

|

|

| 114 Plante Cres

Lake Cowichan Brand New modern affordable homes with legal suites at Stanley Creek Estates. | | 1001608 |

| |

| 8054 Bertha St, Crofton Family home with 2 bedroom suite and ocean views, just a short walk from the Crofton Seawalk. | | 997429 |

| |

| 111 Rollie Rose Dr

Ladysmith Dream family home with 5 bdrms + den, 3 baths, bright open plan & a great location! | | 1001345 |

|

| #3-232 North Shore Rd Lake Cowichan Year-round living or home away from home, own your own lot in this lakeside development! | | 996811 |

|

| 15-658 Alderwood Cr

Ladysmith Retirement living at it's best at Rocky Creek Village. One of the nicest units in one of the nicest parks! | | 1000097 |

|

| 7420 Nantree Rd Youbou Picturesque 4bdrm, 3 bath family home with a park-like 2.5 level acres, pond & lake access just steps away! | | 995173 |

|

| |

|

THINKING OF MAKING A MOVE? LET'S CHAT! |

|

|

| ALLY EARLE * PREC

Team Leader, Associate Broker & Real Estate Professional *denotes Personal Real Estate Corporation |

| |

| JEN PIKE Team Member Real Estate Professional

|

|

| JENNEY MASSEY

Team Member Real Estate Professional

|

|

| Reach out Today! Let us help make your Real Estate Goals a reality! |

|

|

250-710-3181 |  |

|

| |

|

|